Pay now, protect always: Securing digital payments In the age of digitalization, where convenience and efficiency reign supreme, the realm of financial transactions has undergone a significant transformation. With the rise of digital payments, the way we handle money has evolved, offering a seamless and instant transfer of funds at our fingertips. However, along with […]

ECB outlines plans for resilient digital euro

ECB Outlines Plans for a Resilient Digital Euro The European Central Bank (ECB) has recently unveiled its ambitious plans for a digital euro, a move aimed at bolstering Europe’s payment system resilience in the ever-changing financial landscape. The digital euro is not only set to revolutionize the way transactions are conducted but also to ensure […]

Google Cloud develops blockchain network for financial institutions

Google Cloud Develops Blockchain Network for Financial Institutions Google Cloud has recently made waves in the financial industry by developing a cutting-edge blockchain network tailored specifically for financial institutions. Named the Universal Ledger, this innovative platform aims to revolutionize the way assets are tokenized and digital payments are processed within the sector. One of the […]

Visa expands stablecoin settlement to new assets and blockchains

Visa Expands Stablecoin Settlement to New Assets and Blockchains Visa, the global payments giant, is making waves in the world of blockchain technology by expanding its stablecoin settlement capabilities to include new assets and blockchains. In a strategic partnership with Paxos, a leading provider of blockchain infrastructure, Visa aims to enhance its payment network’s efficiency, […]

Crypto executives urged UK to create national stablecoin strategy

Crypto Executives Urge UK to Develop National Stablecoin Strategy In the realm of cryptocurrencies, stability is often a rare commodity. However, stablecoins have emerged as a solution to this volatility, offering a digital asset pegged to a stable reserve asset like the US dollar or gold. Recently, crypto executives have been urging the UK to […]

Russia to phase out Mastercard and Visa

Russia to Phase Out Mastercard and Visa: A Strategic Move Towards Financial Independence In a bold and strategic move, the Central Bank of Russia has announced plans to phase out the use of international payment systems like Mastercard and Visa. This decision marks a significant shift in the country’s financial landscape, aiming to reduce reliance […]

Visa boosts cyber defence support for clients

Visa Enhances Cyber Defense Support for Clients In today’s rapidly evolving digital landscape, cybersecurity has become a critical concern for businesses of all sizes. With the increasing frequency and sophistication of cyber threats, organizations need to prioritize their defense strategies to safeguard their sensitive data and maintain the trust of their customers. Recognizing the importance […]

Mastercard expands crypto partnerships after stablecoin law

Mastercard Expands Crypto Partnerships Following GENIUS Act Clarification The recent development of the GENIUS Act has brought about significant changes in the cryptocurrency landscape, particularly in the realm of stablecoins. This new legislation has provided much-needed clarity on stablecoin rules, paving the way for major players like Mastercard to forge ahead with their crypto initiatives. […]

Bitcoin may surge as Bank of Japan faces key policy decision

Bitcoin May Surge as Bank of Japan Faces Key Policy Decision As the financial world eagerly awaits the Bank of Japan’s upcoming policy decision, all eyes are on the potential impact it could have on not only traditional assets but also on the ever-volatile cryptocurrency market, particularly Bitcoin. Japan, known for its forward-thinking approach to […]

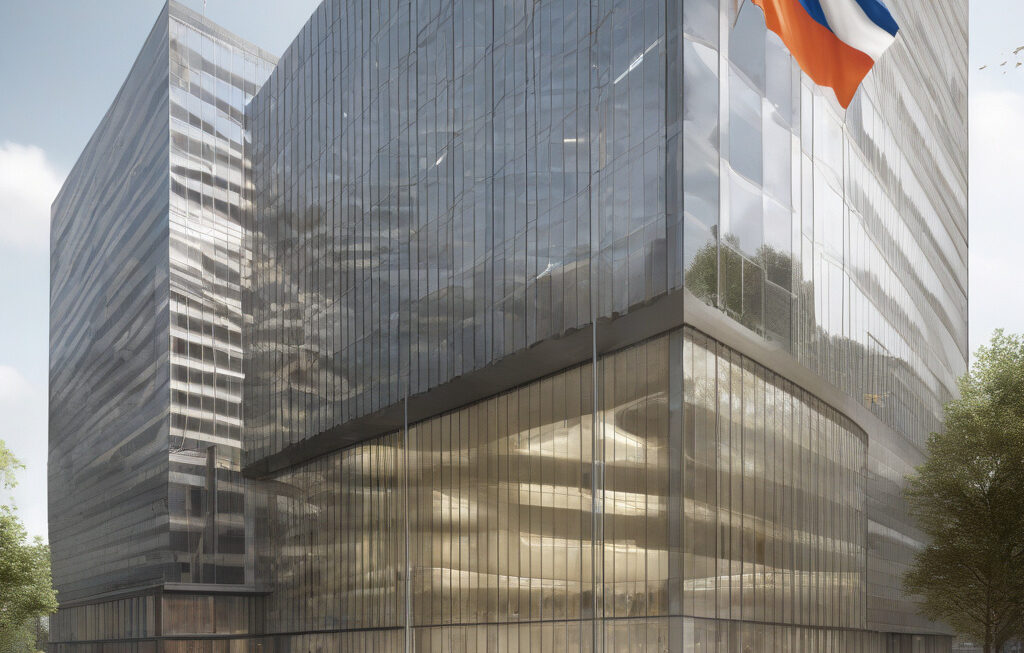

Dutch central bank tells public to prepare for outages

Prepare for Outages: Dutch Central Bank Warns Public of Potential Disruptions The Dutch Central Bank has recently issued a stark warning to the public, urging them to prepare for potential outages that could disrupt digital payment systems. This caution comes amidst growing concerns about the reliability of the country’s power supply and the repercussions it […]