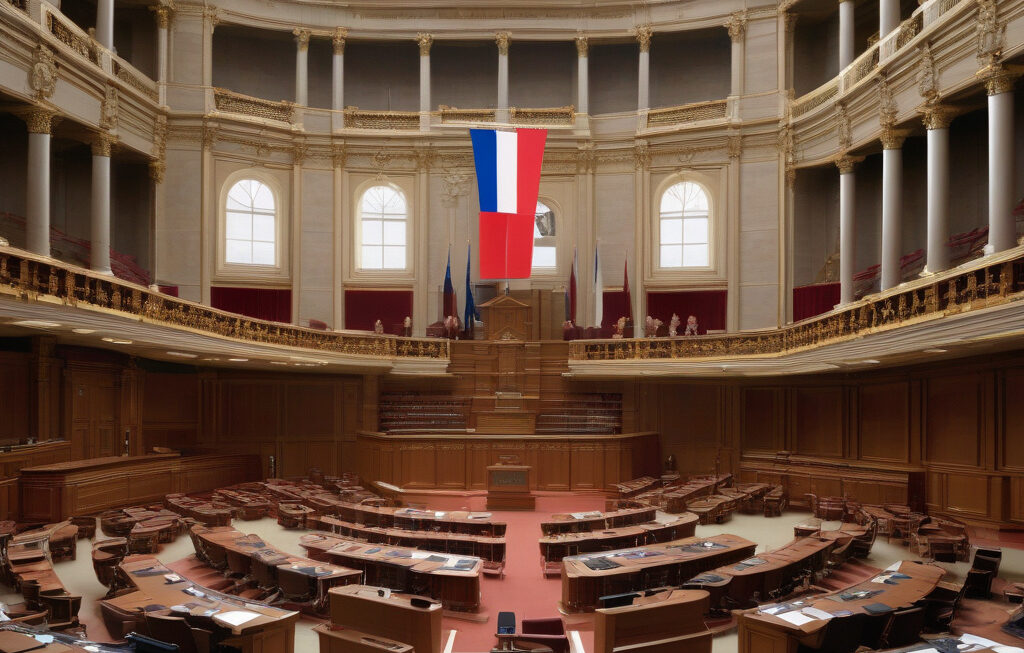

French Lawmakers Advance Plan to Double Digital Services Tax on Big Tech France’s National Assembly has recently made a bold move by backing plans to double the digital services tax on Big Tech companies. This decision comes amidst growing concerns about the fair taxation of tech giants and the need to ensure that they contribute […]

Google settles tax dispute in Italy for 326 million euros

Google Settles Tax Dispute in Italy for 326 Million Euros Tech giant Google recently reached a settlement in Italy, putting an end to a long-standing tax dispute. The company agreed to pay a hefty sum of 326 million euros following allegations of tax evasion in the European country. This legal case sheds light on the […]

OECD and WTO joint report highlights economic impact of data regulation and advocates balanced approach

The Economic Impact of Data Regulation: Insights from OECD and WTO In the digital age, data has become the lifeblood of economies worldwide, fueling innovation, driving productivity, and transforming industries. However, the regulation of data flows and the growing trend of data localization have raised concerns about their potential economic impact. A recent joint report […]

Australia's Crypto Taxation Framework: A Critical Review for the Future

Australia is at a pivotal juncture regarding the taxation of cryptocurrencies. With an impressive 20% of the population now owning digital assets, the government recognizes the need for a robust regulatory framework to manage this burgeoning market. The Australian Treasury is seeking guidance from the Organisation for Economic Co-operation and Development (OECD) to shape its […]