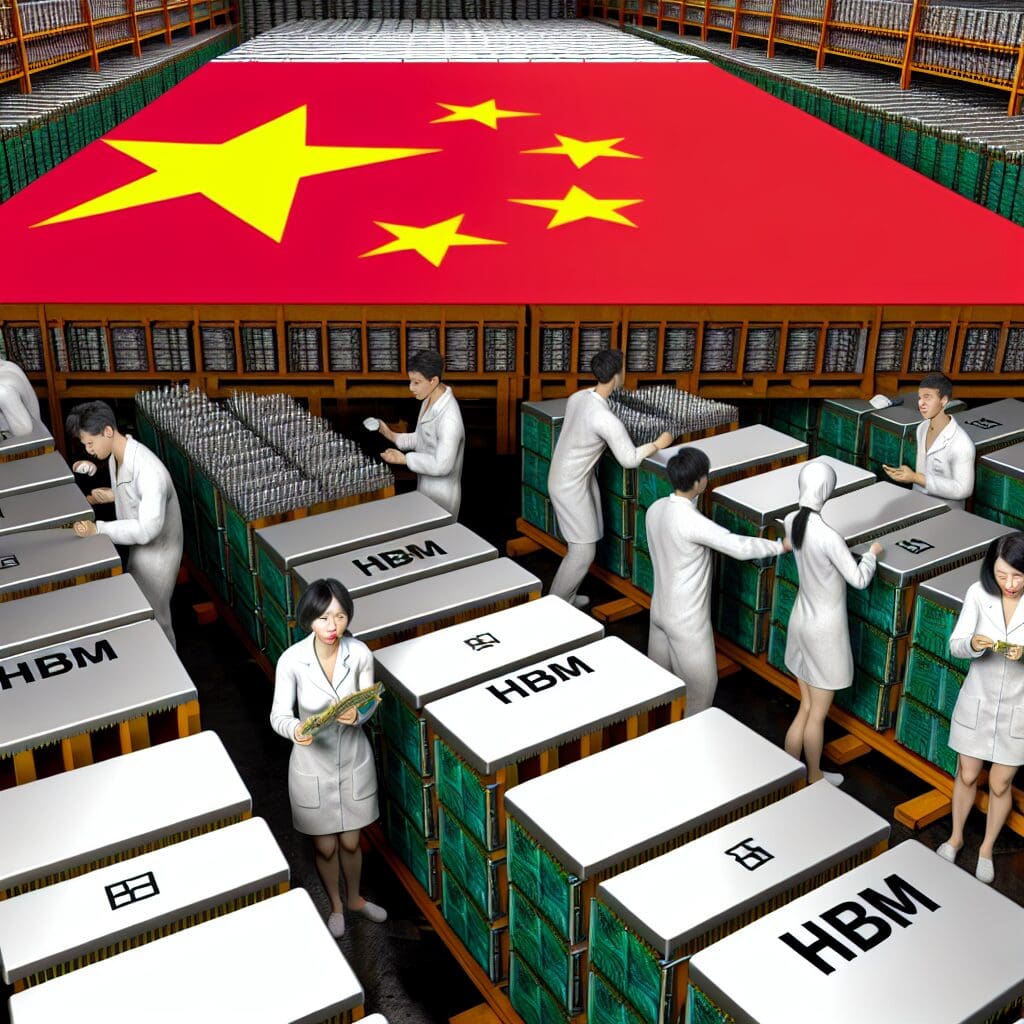

Chinese semiconductor companies are currently responding to U.S. export restrictions by stockpiling High Bandwidth Memory (HBM) chips, particularly the older HBM2E model. This reaction is driven by limited access to advanced HBM3E chips due to stringent trade regulations that affect supply chains and technology transfer.

The United States implemented these export restrictions to curtail China’s burgeoning semiconductor capabilities, especially in sectors deemed critical to national security. The new rules not only impact the acquisition of advanced chips but also pose challenges for domestic R&D efforts within China.

Chinese firms, in anticipation of potential supply shortages, are ramping up their inventories. According to industry sources, companies like Huawei and Yangtze Memory Technologies Co. (YMTC) are proactively securing HBM2E chips, recognizing that relying solely on local production may not meet their high-performance computing needs in the near future. These firms aim to stabilize their supply chains while navigating the geopolitical landscape.

This stockpiling strategy illustrates a broader trend where companies adapt to external pressures by diversifying their sources and securing vital components. As the global semiconductor market continues to evolve, China’s approach to managing these challenges will likely influence its technological advancements and strategic positioning in the industry.

For businesses and investors engaged in the tech sector, understanding these dynamics is critical. This situation underscores the importance of resilience and adaptability in supply chain management, particularly in high-tech industries where innovation and speed are essential.