El Salvador Grapples with IMF Restrictions on Bitcoin Transactions

El Salvador made waves in the financial world when it became the first country to adopt Bitcoin as legal tender. However, this bold move has not been without its challenges. Recently, the International Monetary Fund (IMF) has placed restrictions on El Salvador regarding its use of Bitcoin. The IMF has emphasized that the government should not accrue Bitcoin or issue debt instruments tied to it. This comes as a means to improve governance, transparency, and economic resilience while mitigating risks associated with the volatile nature of cryptocurrencies.

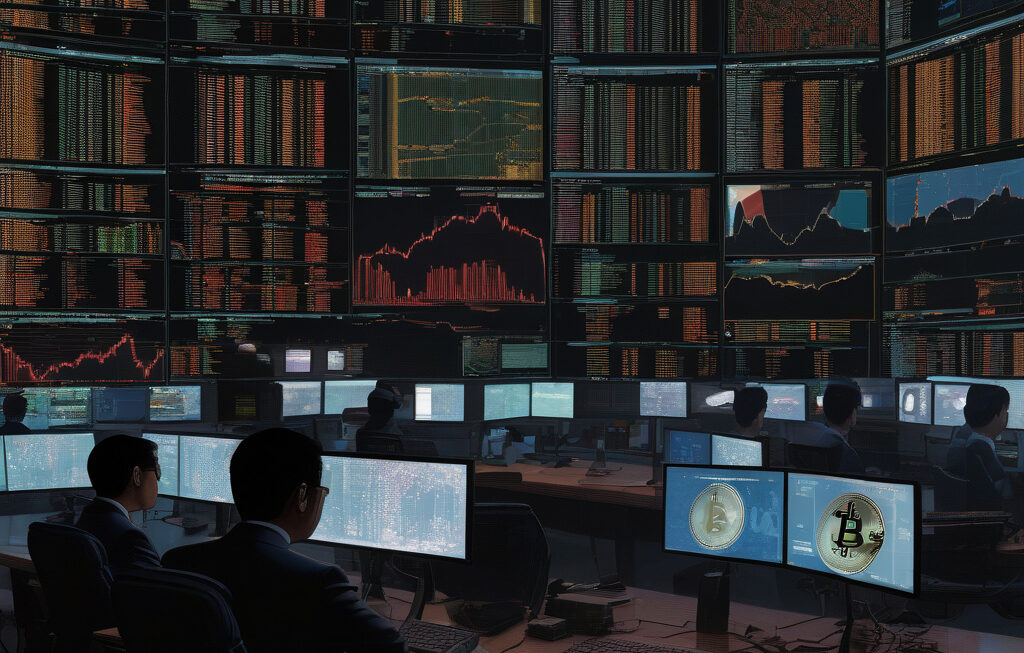

The IMF’s stance raises important questions about the future of Bitcoin in El Salvador and the potential impact of these restrictions on the country’s economy. While Bitcoin has garnered attention for its potential to revolutionize the financial sector, its extreme volatility poses risks that must be carefully managed, especially by governments looking to integrate it into their economies.

One of the key concerns highlighted by the IMF is the potential for El Salvador to accrue large amounts of Bitcoin, which could lead to significant financial instability. By advising against the accumulation of Bitcoin, the IMF aims to protect El Salvador from the unpredictable fluctuations that have become synonymous with the cryptocurrency market. This recommendation underscores the importance of implementing sound financial practices and risk management strategies when dealing with digital assets.

Furthermore, the IMF’s restriction on issuing debt instruments tied to Bitcoin is a precautionary measure aimed at safeguarding El Salvador’s economy from potential speculative activities. By prohibiting the creation of debt instruments linked to Bitcoin, the IMF aims to prevent the country from exposing itself to excessive risk that could jeopardize its economic stability. This restriction signals the IMF’s commitment to promoting responsible financial behavior and ensuring that countries adopt sustainable practices in their use of cryptocurrencies.

El Salvador’s experience serves as a valuable case study for other nations considering the adoption of Bitcoin or other cryptocurrencies. While the allure of digital currencies is undeniable, the risks associated with their volatility and lack of regulation cannot be ignored. By heeding the IMF’s advice and implementing measures to enhance governance and transparency, countries can navigate the complexities of the cryptocurrency landscape more effectively.

In conclusion, El Salvador’s encounter with IMF restrictions on Bitcoin transactions sheds light on the challenges and considerations involved in integrating cryptocurrencies into traditional financial systems. As the world continues to explore the possibilities of digital currencies, it is essential for governments and financial institutions to approach this new frontier with caution and foresight. By striking a balance between innovation and risk management, countries can harness the potential benefits of cryptocurrencies while safeguarding their economies against unforeseen challenges.

Bitcoin, IMF, El Salvador, cryptocurrency, financial stability