AI Startup Blaize Targets IPO Amid Growing Investor Interest

Blaize, a California-based AI chipmaker specializing in edge computing solutions, is making waves in the tech industry as it gears up to go public. The company’s decision to pursue an initial public offering (IPO) through a Special Purpose Acquisition Company (SPAC) deal comes at a time when investor interest in AI technology is at an all-time high. With a valuation of $1.2 billion, Blaize’s upcoming IPO is poised to be a significant milestone not only for the company but also for the rapidly expanding AI chip sector.

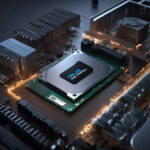

Founded with a vision to revolutionize edge computing through cutting-edge AI hardware, Blaize has quickly established itself as a key player in the industry. The company’s innovative approach to developing AI chips that are specifically designed for edge applications has garnered attention from both customers and investors alike. By focusing on the unique requirements of edge computing, Blaize has been able to deliver high-performance, energy-efficient solutions that address the growing demand for AI processing at the edge.

The decision to pursue an IPO through a SPAC deal highlights Blaize’s confidence in its business strategy and growth prospects. SPACs have become an increasingly popular way for companies to go public, offering a faster and more streamlined alternative to traditional IPOs. By merging with a SPAC, Blaize can expedite the process of becoming a publicly traded company while also benefiting from the expertise and resources of its SPAC partner.

The $1.2 billion valuation assigned to Blaize underscores the company’s potential for long-term success in the AI chip market. As the demand for AI-powered technologies continues to rise across various industries, companies like Blaize are well-positioned to capitalize on this trend. Edge computing, in particular, presents a significant growth opportunity for AI chipmakers, as more devices and applications require on-device AI processing to enable real-time decision-making and efficiency.

Investor interest in AI chip companies has been steadily increasing in recent years, driven by the rapid advancement of AI technologies and their widespread adoption in diverse sectors such as automotive, healthcare, and manufacturing. As AI becomes increasingly integrated into everyday devices and systems, the need for specialized AI hardware solutions will only continue to grow. Blaize’s focus on edge computing aligns with this market trend, positioning the company as a key player in shaping the future of AI-driven edge applications.

In conclusion, Blaize’s decision to target an IPO amid growing investor interest reflects not only the company’s confidence in its technology and market potential but also the broader excitement surrounding AI chip companies. With a valuation of $1.2 billion and a strategic focus on edge computing, Blaize is poised to make a significant impact in the AI chip industry and beyond.

AI, Startup, Blaize, IPO, Investor Interest