In December 2023, El Salvador achieved a significant milestone by surpassing 6,000 Bitcoin in its national reserves. This comes on the heels of its groundbreaking decision to recognize Bitcoin as legal tender in September 2021, making it the first nation in the world to do so. This bold move positioned El Salvador not only as a pioneer in the cryptocurrency movement but also as the sixth-largest holder of Bitcoin globally.

The implications of this decision extend far beyond national pride or economic strategy; they signal a shift in how nations can approach digital currencies. By embracing Bitcoin, El Salvador has introduced a new framework that other countries may look to as they ponder their relationships with cryptocurrency. This article analyzes the factors that led to this momentous achievement, its implications for the nation and the global financial landscape, and the potential challenges that lie ahead.

Firstly, one of the notable aspects of El Salvador’s Bitcoin strategy is Carlos Alvarado’s visionary leadership. The President has been vocal about the potential of Bitcoin to transform the country’s economy. By enabling a framework for Bitcoin transactions, Alvarado aimed to attract foreign investment, enhance financial inclusion, and provide a practical solution to tackle the remittance problem affecting Salvadorans abroad. Remittances, which account for a substantial portion of the country’s GDP, can be costly due to high transaction fees from traditional financial institutions.

A study from the World Bank asserts that over 2.5 million Salvadorans live in the United States. By using Bitcoin for remittances, Salvadorans have begun to save on conversion fees, which typically eat into their income. As more citizens adopt digital wallets, there has been a noticeable increase in transactional efficiency and reduced reliance on cash. This creates an opportunity for economic development that aligns with the global shift towards digital finance.

Additionally, the Salvadoran government has taken tangible steps to encourage Bitcoin adoption through incentives. For instance, they established a $30 Bitcoin incentive for citizens who downloaded the government-backed digital wallet. This initiative has drawn attention to Bitcoin and provided individuals with a small starting investment in cryptocurrency. By increasing the user base and facilitating education around Bitcoin, the government is investing in long-term financial literacy and involvement.

However, alongside these positive developments, there are significant challenges that El Salvador faces on this journey. The volatility of Bitcoin poses a substantial risk. Since its introduction as legal tender, the value of Bitcoin has experienced significant fluctuations, which can affect everything from purchasing power to budgeting for public spending. This instability may deter potential investors who are wary of volatility impacts on economic stability.

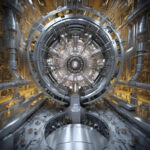

Furthermore, international scrutiny and skepticism surrounding Bitcoin’s environmental impact cannot be overlooked. Critics argue that cryptocurrency mining is a resource-intensive process that contributes to rising greenhouse gas emissions. In response to this concern, El Salvador has aimed to diversify its energy sources by employing geothermal energy harnessed from its volcanic landscape, thus proposing a sustainable approach to Bitcoin mining. For instance, the government revealed initiatives to set up Bitcoin mining operations powered by volcanic energy, which could mitigate concerns about environmental sustainability.

Moreover, the social implications of adopting cryptocurrency cannot be underestimated, as many citizens remain skeptical about this digital currency. As the government promotes Bitcoin, it must simultaneously invest in education and awareness campaigns to build confidence among its citizens. Lack of understanding could lead to misinformation and distrust, potentially stalling broader acceptance.

Despite the hurdles, El Salvador’s recent achievement of over 6,000 Bitcoin in reserves has placed it at the forefront of a global conversation about cryptocurrency. The pioneering step has encouraged significant discussions about the role of digital currencies at the national level. Other nations are now observing how this bold experiment unfolds, and what results arise in terms of economic growth, innovation, and social change.

In conclusion, El Salvador’s breach of the 6,000 Bitcoin milestone represents not only a national accomplishment but a signal for other countries wrestling with cryptocurrency adoption. As El Salvador promotes a vision of an empowered economy through digital assets, the world watches. The outcomes of this daring endeavor will serve as case studies for developing nations considering embracing cryptocurrency as a mainstream financial instrument.