In recent months, a remarkable trend has emerged within the wellness sector, closely following the pharmaceutical industry’s innovations. The spotlight is on GLP-1 receptor agonists, hormones that have gained notoriety due to their association with popular weight loss drugs like Ozempic and Wegovy. As wellness brands jostle to stake their claim in this burgeoning field, a notable phenomenon dubbed the “Ozempiconomy” is taking shape.

The burgeoning interest stems from a compelling statistic: searches for “GLP-1 supplement” surged by an astonishing 792.1 percent year-over-year in 2024. This remarkable growth illustrates the growing consumer appetite for products linked to GLP-1, a hormone typically associated with reduced hunger and enhanced weight management. The allure of these hormones, which were initially used in diabetes management, has expanded, prompting wellness brands to introduce a variety of supplements designed to support or mimic the effects experienced from prescribed medications.

Kourtney Kardashian’s brand, Lemme, recently debuted its new GLP-1 supplement, claiming to support the body’s natural GLP-1 hormone production while curbing appetite and aiding weight management. This move aligns with a wave of similar products hitting the market, which proposes to boost or “support” GLP-1 levels, often relying on carefully selected language to navigate regulatory scrutiny. Brands like Pendulum and Codeage market GLP-1 Probiotics, while Supergut’s Gut Healthy GLP-1 Booster caters to health-conscious consumers eager to explore alternative weight management strategies.

The potential for profit within the Ozempiconomy is significant. Notably, Novo Nordisk, the company behind Wegovy, became more valuable than LVMH, the luxury goods giant, overtaking it as the highest market cap company in Europe based on weight loss medications’ success. Insights from Circana reveal that weight management is a top priority for 43% of US consumers, ranking third in wellness trends, just behind improved physical health and reduced stress levels.

Interestingly, the appeal of these products extends beyond traditional weight-loss seekers. Many customers are looking for alternatives due to concerns about the potential side effects and high costs associated with GLP-1 agonists. Major pharmaceutical treatments like Eli Lilly’s Mounjaro and Novo Nordisk’s Wegovy can cost anywhere from $1,174 to $1,524 per month. In contrast, supplements touting GLP-1 support can retail for as little as $29 for a month’s supply, making them an attractive option for cost-conscious consumers.

However, experts caution that these supplements do not provide direct substitutes for prescription medications. “Natural GLP-1 is broken down quickly by enzymes,” explains Dr. Rekha Kumar, founder of a weight loss telehealth startup. “GLP-1 medications are engineered to resist this breakdown, allowing them to curb hunger effectively over extended periods.” Given this significant difference, while supplements may contribute to overall wellness, they are unlikely to replicate the effects of prescription GLP-1 medications.

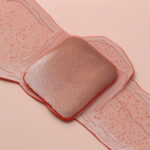

The market is not only targeting those searching for alternatives to GLP-1 medications. Their offerings cater to those already on such prescriptions. For instance, brands like SoWell have introduced products to mitigate the common side effects of GLP-1 medications, such as nausea and dizziness. The SoWell GLP-1 Support System comprises fiber, protein, and electrolyte powders enabling consumers to balance their diets while aiding their medication journey.

Moreover, familiar brands within the fitness industry are now integrating GLP-1 support products into their offerings. Leading gym chains like Equinox and Life Time have rolled out specialized training programs aimed at individuals on GLP-1 medications, linking exercise to dietary strategies for weight management. Additionally, health and nutrition brands are creating meal plans specifically designed for individuals leveraging the benefits of GLP-1 injections, further embedding these concepts into mainstream wellness culture.

As wellness brands adeptly position themselves to harness the growing interest in GLP-1, the landscape appears promising. However, navigating the complexities of consumer expectations while ensuring product efficacy will require diligence. Pioneering companies must strike a balance—leveraging the market’s interest without overpromising what their products can deliver. Ultimately, as more brands jump onto the Ozempiconomy bandwagon, consumers will be paying close attention.

The integration of GLP-1 related products into the wellness market highlights a key intersection of healthcare and consumer choice, catering to an audience that desires both efficacy and accessibility. This evolution presents a unique opportunity for established brands to innovate while addressing the undeniable consumer demand for more holistic health and wellness solutions.