In a significant move, Saudi Arabia’s Public Investment Fund (PIF) has finalized an agreement to acquire a 40% stake in the renowned UK department store chain, Selfridges. This transaction comes in the wake of the insolvency of Signa Group, Selfridges’ previous joint venture partner. The PIF’s investment will bolster Selfridges’ operational and financial position during a challenging time for the luxury retail sector.

The newly formed partnership structure sees the Thai conglomerate Central Group maintaining a 60% controlling stake while also committing to further investment alongside the PIF. This strategic partnership is designed to stabilize Selfridges, which has been under financial strain due to fluctuating market conditions exacerbated by the challenges of the post-pandemic retail landscape. Although specific financial details of the deal were not disclosed, the implications of this acquisition are vast.

Turqi Al-Nowaiser, deputy governor and head of international investments at PIF, expressed optimism about the deal. He stated, “We are pleased to be partnering with Central Group in Selfridges Group, one of Europe’s most iconic luxury department stores. This transaction allows Selfridges Group to build on its position as a premier retail destination.” His statement underscores the strategic importance of Selfridges not just as a retail outlet, but as a cultural landmark in luxury shopping.

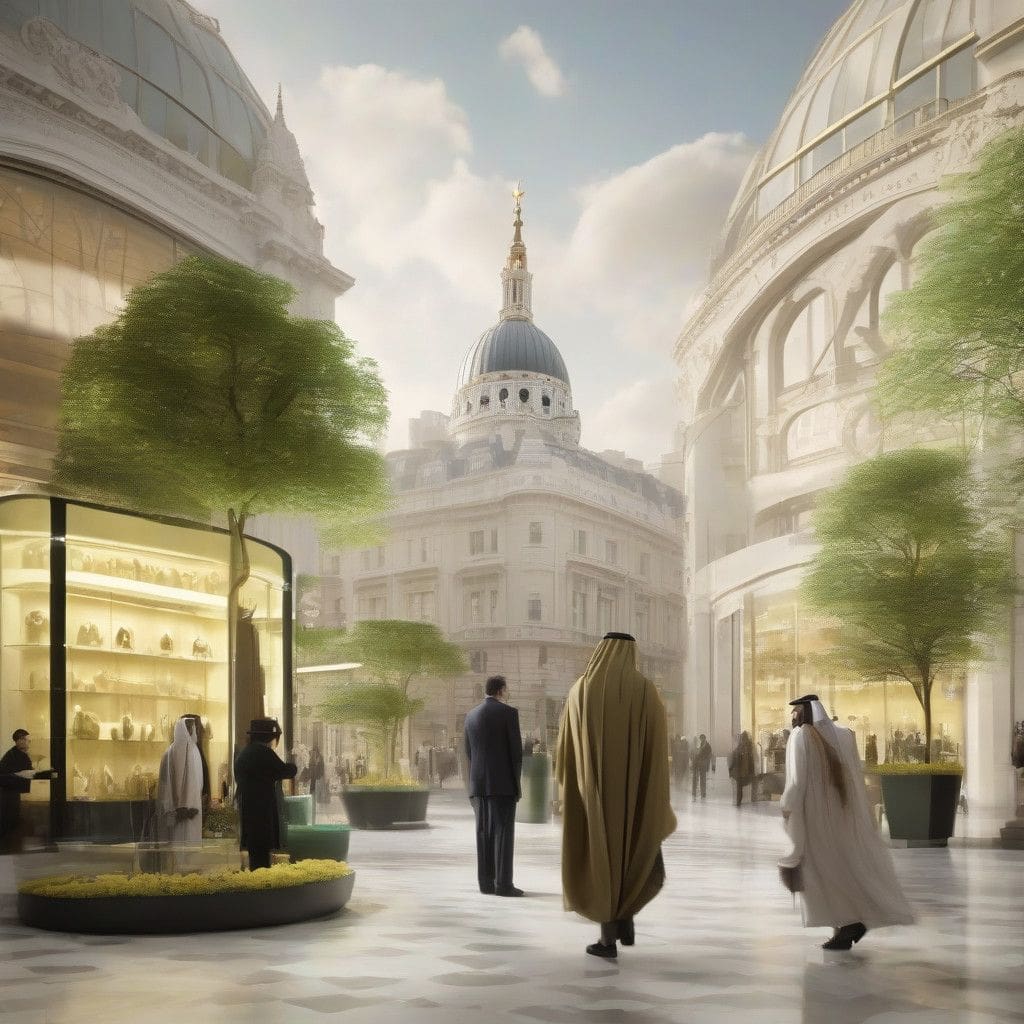

Selfridges has a storied history that dates back to its founding in 1908 by Harry Gordon Selfridge. It has since evolved into one of the most influential department stores in the UK, operating 18 outlets across three countries—Selfridges in the UK, De Bijenkorf in the Netherlands, and Brown Thomas and Arnotts in Ireland. Its flagship store on Oxford Street in London remains a key destination for both tourists and locals.

The transaction also provides insights into the challenges currently facing the retail sector. The previous owner, Signa Group founded by Rene Benko, faced significant financial distress, culminating in its insolvency. The failure of this joint venture has triggered a reevaluation of other investments within Central’s portfolio, including its operations in Swiss luxury department stores like Globus and KaDeWe in Berlin.

PIF, which already held a 10% stake in Selfridges through a prior investment, is now taking a more active role in one of the most storied department stores in the world. The fund has been expanding its investments in various sectors globally, but this move into retail is particularly noteworthy amid a global shift towards luxury brands increasingly acknowledging and adapting to changing consumer behaviors and market dynamics.

What can we learn from this transaction in the context of retail evolution? It illustrates the increasing trend of sovereign wealth funds entering the consumer retail market, particularly in luxury segments. The collaboration between the PIF and Central Group also signifies a recognition of the value and potential found in established brands that resonate with affluent consumers globally.

Furthermore, this partnership could lead to innovative marketing and operational strategies aimed at revitalizing Selfridges’ appeal. As consumers navigate their post-pandemic shopping preferences, blending digital an in-store experiences becomes vital. This transition might also involve leveraging PIF’s extensive knowledge of international markets to expand Selfridges’ reach beyond its current demographics.

In conclusion, the acquisition of a significant stake in Selfridges by Saudi Arabia’s Public Investment Fund marks a pivotal moment not only for the department store but also for the global retail landscape. It highlights the relevance of strategic partnerships in overcoming financial challenges and propelling businesses towards future growth. As the luxury retail sector adapts to new realities, the collaboration between PIF and Central Group could very well serve as a model for success in the face of adversity.