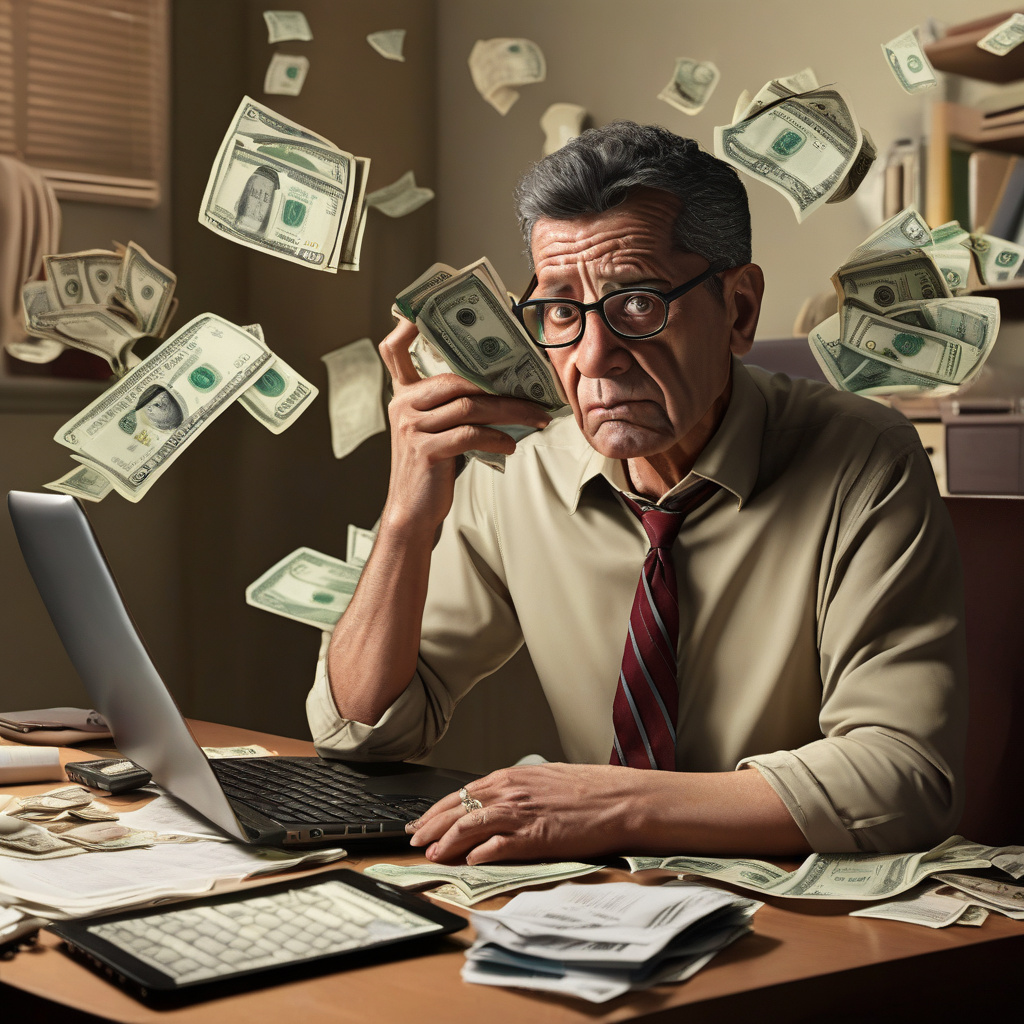

Beware of Fake Banking Apps: A Growing Scam Leaving Sellers Thousands Out of Pocket

In today’s digital age, where convenience is at the forefront of transactions, scammers are finding new ways to exploit unsuspecting individuals. One such alarming trend is the rise of fake banking apps that are so convincing in their appearance that victims are easily duped into believing they have received payment for goods or services. However, the reality is far from it, leaving sellers at a significant financial loss.

The modus operandi of these fraudulent apps is simple yet effective. They mimic the interfaces of legitimate banking apps, often using logos and color schemes that are identical to the real ones. This level of detail is what lures in sellers, who, upon seeing what appears to be a payment notification, proceed with delivering the goods, only to realize later that no money has been transferred to their account.

The consequences of falling victim to this scam can be devastating. Sellers not only lose out on the value of the goods they have parted with but also the time and effort invested in the transaction. Moreover, the emotional toll of being deceived in such a manner can be significant, eroding trust and confidence in online payment systems.

One of the challenges in combating this issue is the rapid advancement of technology, which makes it easier for scammers to create authentic-looking fake apps. While app stores have measures in place to detect and remove fraudulent applications, new ones continue to emerge, making it a game of cat and mouse between authorities and scammers.

So, what can sellers do to protect themselves from falling prey to these fake banking apps? Vigilance is key. Before completing any transaction, it is crucial to verify the payment directly with your bank or through official banking channels. Cross-referencing the transaction details provided by the buyer with those on your banking app can help in detecting discrepancies.

Additionally, staying informed about the latest scams and trends in online fraud can help individuals stay one step ahead of scammers. Education and awareness are powerful tools in the fight against cybercrime, and by arming oneself with knowledge, sellers can reduce their vulnerability to such schemes.

In conclusion, the proliferation of fake banking apps is a stark reminder of the risks that come with conducting financial transactions in the digital realm. While technology has undoubtedly made our lives easier, it has also opened up new avenues for exploitation. By remaining cautious, verifying transactions, and staying informed, individuals can protect themselves from falling victim to such scams and prevent significant financial losses.

scam, fake apps, online fraud, banking security, financial protection