In a groundbreaking move for the cryptocurrency landscape, the Philippine Securities and Exchange Commission (SEC) has introduced new regulations aimed at guiding the rapidly evolving digital asset sector. This initiative is not just a formality; it represents a critical step in establishing a regulatory framework that aims to foster innovation while ensuring investor protection.

The proposed regulations outline clear guidelines for various service providers, including those involved in trading, custody, and public offerings of cryptocurrencies. These guidelines are essential for mitigating risks associated with fraud and market manipulation, which have plagued the industry and deterred potential investors.

Establishing a Structured Framework

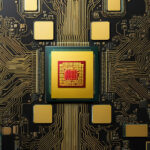

The SEC’s new proposals signal a shift towards a more structured approach to cryptocurrency regulation. By defining roles and responsibilities for service providers, the SEC aims to create an environment that encourages responsible growth within the sector. For instance, entities providing trading services will be required to register with the SEC and obtain the necessary licenses. This licensing requirement will ensure that only qualified operators can participate in the market, ultimately protecting consumers from unscrupulous actors.

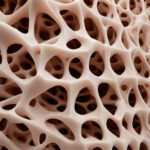

Furthermore, custody providers, which are responsible for safeguarding digital assets, will also face stricter scrutiny. These custodians must demonstrate their ability to securely hold assets and manage risks effectively. The SEC’s focus on custody reflects a growing recognition of the integral role that digital asset security plays in maintaining market integrity.

Combating Fraud and Market Manipulation

One of the most pressing issues in the cryptocurrency space has been the prevalence of scams and market manipulation schemes. By imposing new regulations, the Philippine SEC aims to combat these activities head-on. The proposed rules dictate that service providers must implement robust anti-fraud measures, including transparency protocols and reporting requirements. This commitment to transparency is vital for building trust between investors and service providers.

Moreover, the SEC plans to establish strict rules surrounding public offerings of cryptocurrencies. These rules will require detailed disclosures about the risks and potential returns associated with digital assets. By mandating transparency, the SEC is taking proactive steps to prevent fraudulent practices that have tarnished the reputation of the cryptocurrency industry.

Promoting Innovation

While the primary goal of these regulations is to protect investors, the SEC has also made it clear that it does not seek to stifle innovation within the sector. By providing a regulatory framework that encourages compliance, the SEC aims to create a level playing field where legitimate businesses can thrive. This balance is essential; overly restrictive regulations could push innovative companies to more lenient jurisdictions, stunting growth in the local market.

For example, many tech companies have relocated to nations with more favorable regulatory environments for cryptocurrencies. The Philippine SEC must, therefore, ensure that its regulations are not only protective but also conducive to business growth. By doing this, the SEC can bolster the Philippines’ position as a prospective hub for technological innovation in Southeast Asia.

Potential Impact on the Market

The introduction of these regulations could have significant implications for the cryptocurrency market in the Philippines. If successful, the SEC’s initiatives could attract both local and international investors, leading to increased investment in the sector. Furthermore, as reputable service providers emerge under these regulations, investor confidence is likely to grow. This increase in confidence can enhance the overall market stability, encouraging more individuals and institutions to enter the cryptocurrency space.

Additionally, markets often respond positively to regulation as it can reduce volatility associated with unregulated markets. By establishing clear guidelines, the SEC can help to minimize sudden price swings that have become synonymous with cryptocurrencies.

Conclusion

The Philippine SEC’s proposal for new cryptocurrency regulations is a thoughtful and necessary step toward creating a structured, secure, and innovative environment for digital assets. By prioritizing consumer protection while promoting responsible growth, the SEC aims to position the Philippines as a significant player in the global cryptocurrency landscape. The outcomes of these proposed regulations will likely be closely watched not only within the country but also by other jurisdictions seeking to enhance their regulatory frameworks.

As the landscape of cryptocurrency continues to evolve, it is crucial that regulatory bodies remain adaptable and responsive. The Philippine SEC’s proactive approach could serve as a valuable model for other countries as they navigate the complexities of digital asset regulation.