The ongoing legal ramifications of the Cambridge Analytica scandal are poised for an important evaluation as the US Supreme Court considers a significant securities fraud lawsuit against Meta Platforms, Inc., known previously as Facebook. This case, led by plaintiffs including Amalgamated Bank, focuses on whether Facebook misled investors by not adequately disclosing a massive data breach involving the misuse of user data by Cambridge Analytica in 2015. The implications of this case could reshape the standards for corporate disclosures in the tech industry and beyond.

Investors allege that Facebook’s failure to disclose essential information about the breach obscured the true risks associated with investing in the company. They argue that instead of presenting the incident as a concrete fact—one that jeopardized user trust and, subsequently, the company’s value—Facebook characterized it as a hypothetical risk. This distinction is crucial, as it highlights the potential for misleading communications to investors and raises questions about what level of transparency is required by law.

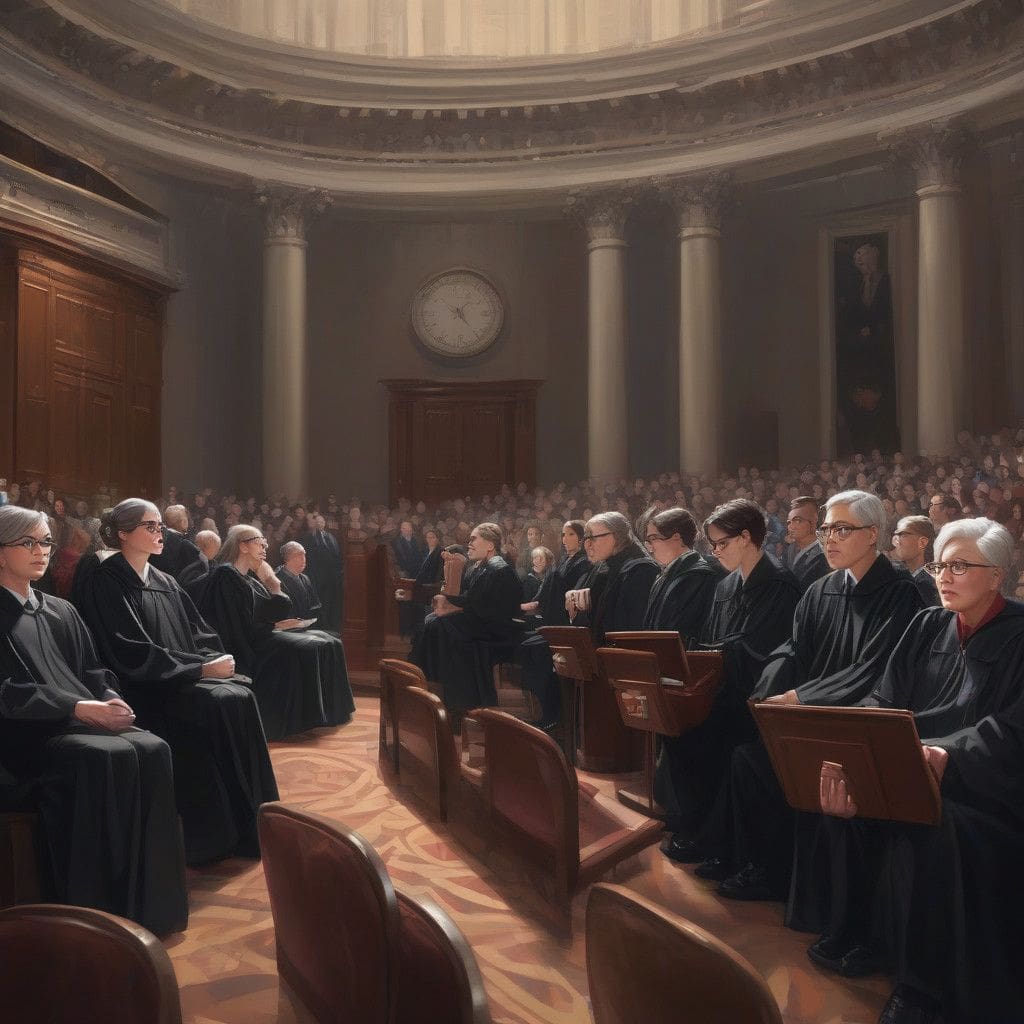

During oral arguments, the justices explored the nuances of what constitutes a misleading statement. Chief Justice John Roberts remarked that the risk disclosures could imply past occurrences, while Justice Clarence Thomas pointed out that vague language surrounding risks might imply that such incidents had not actually occurred. These exchanges underscore significant concerns regarding the sufficiency of current disclosure standards set forth by the Securities Exchange Act, which requires publicly traded companies to provide transparent information about risks that could affect their stock prices.

This case isn’t isolated; it is one of two critical Supreme Court deliberations currently examining corporate transparency in the context of investor disclosures. A ruling in favor of the plaintiffs could elevate the expectations firms face when reporting both existing and prospective risks. Upholding higher standards for what companies must disclose could not only impact the tech sector but ripple across various industries where investor trust is paramount.

The broader context of this case aligns with increasing scrutiny of tech giants regarding their data privacy and security practices. For instance, following the Cambridge Analytica scandal, there has been a significant push for legislative reforms aimed at enhancing data protection. Governments worldwide are grappling with how to instill greater accountability in firms handling vast amounts of personal data. The outcomes of this Supreme Court case may serve as a precedent, influencing future litigation and legislative measures.

The implications of social media data mishandling are profound—not only for corporate governance and investor relations but also for individuals’ privacy rights. Furthermore, the actions of tech giants can foster distrust among consumers, which, in turn, can affect their bottom line. Thus, stakeholders ranging from investors to the general public watch closely as this case unfolds.

The high court’s decision, expected in June, could have lasting repercussions for how companies in the tech industry interact with their stakeholders. Not only could it redefine the thresholds for necessary disclosures, but it might also encourage greater diligence in reporting data risks. As corporations increasingly operate within an interconnected digital landscape, establishing robust frameworks for transparency and accountability remains a pressing challenge.

In conclusion, the Supreme Court’s forthcoming ruling on Facebook’s role in the Cambridge Analytica scandal is set to resonate across the corporate world. As investors, consumers, and regulators await the decision, one thing remains clear: transparency and accountability within the tech industry are no longer just expectations but essential elements for building trust in an age of digital uncertainty.